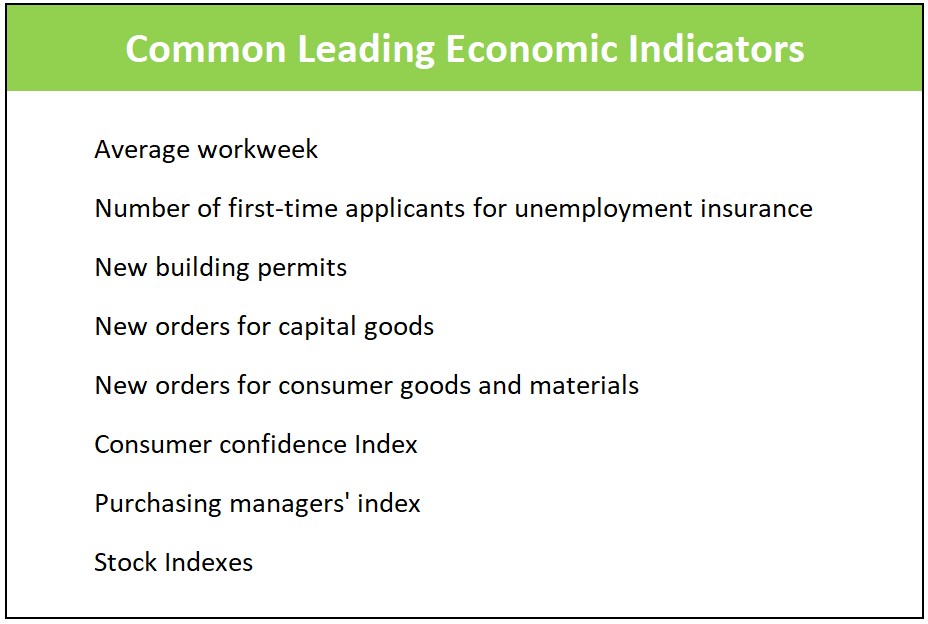

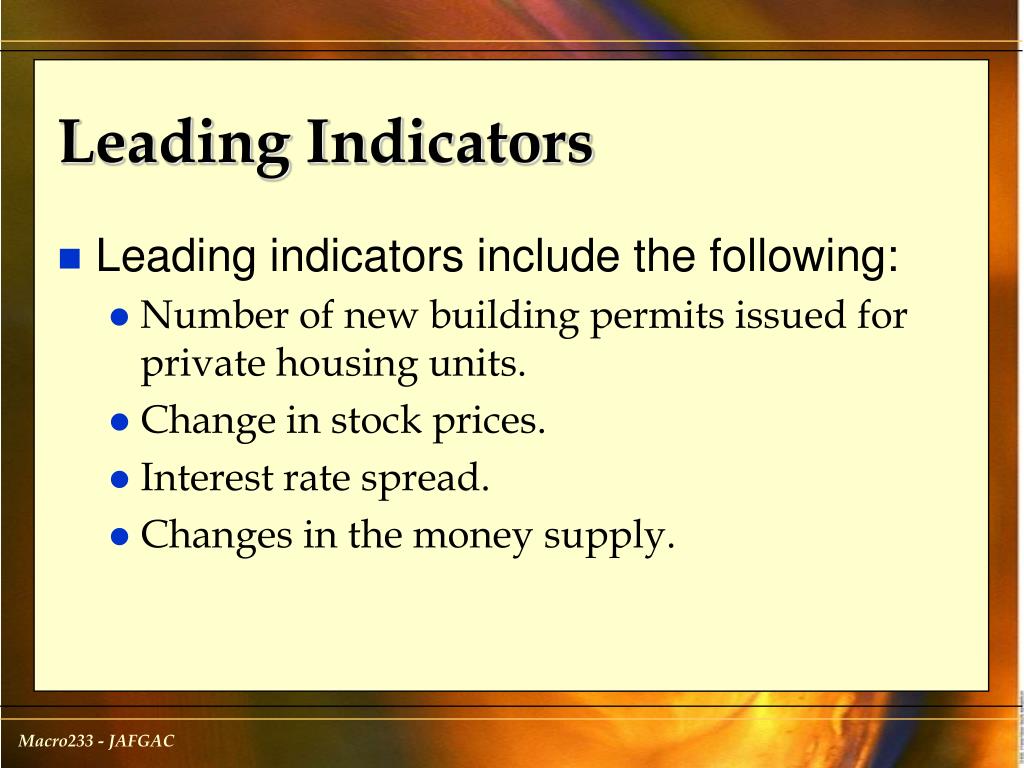

Summary: Leading indicators are crucial economic data points that can predict future economic activity. They play a vital role for businesses, investors, and policymakers in forecasting economic shifts. This article explores the definition of leading indicators, their significance, examples, accuracy, and how they differ from lagging indicators.. Economic indicators are statistics that indicate changes in the economy. They are classified as leading or lagging, based on their timing. Leading economic indicators are those that change before economies show any signs of change. Leading indicators are used by investors to help predict the direction of economies and make predictive investing.

U.S. Leading Economic Indicators Index Continues to Fall in February

:max_bytes(150000):strip_icc()/economics-source-67f961336a45429f890f74eb2d90cf0d.png)

Economics Defined with Types, Indicators, and Systems

4 Stages of the Economic Cycle Vica Partners

Definition of Leading Economic Indicators Higher Rock Education

Leading Lagging And Coincident Indicators

PPT Economic Growth, Business Cycles, Unemployment, and Inflation

Types of Economic Indicators Leading, Coincident & Lagging

Economic Indicators

What are Economic Indicators Leading, Lagging & Coincident Indicators

Leading Indicator In A Nutshell FourWeekMBA

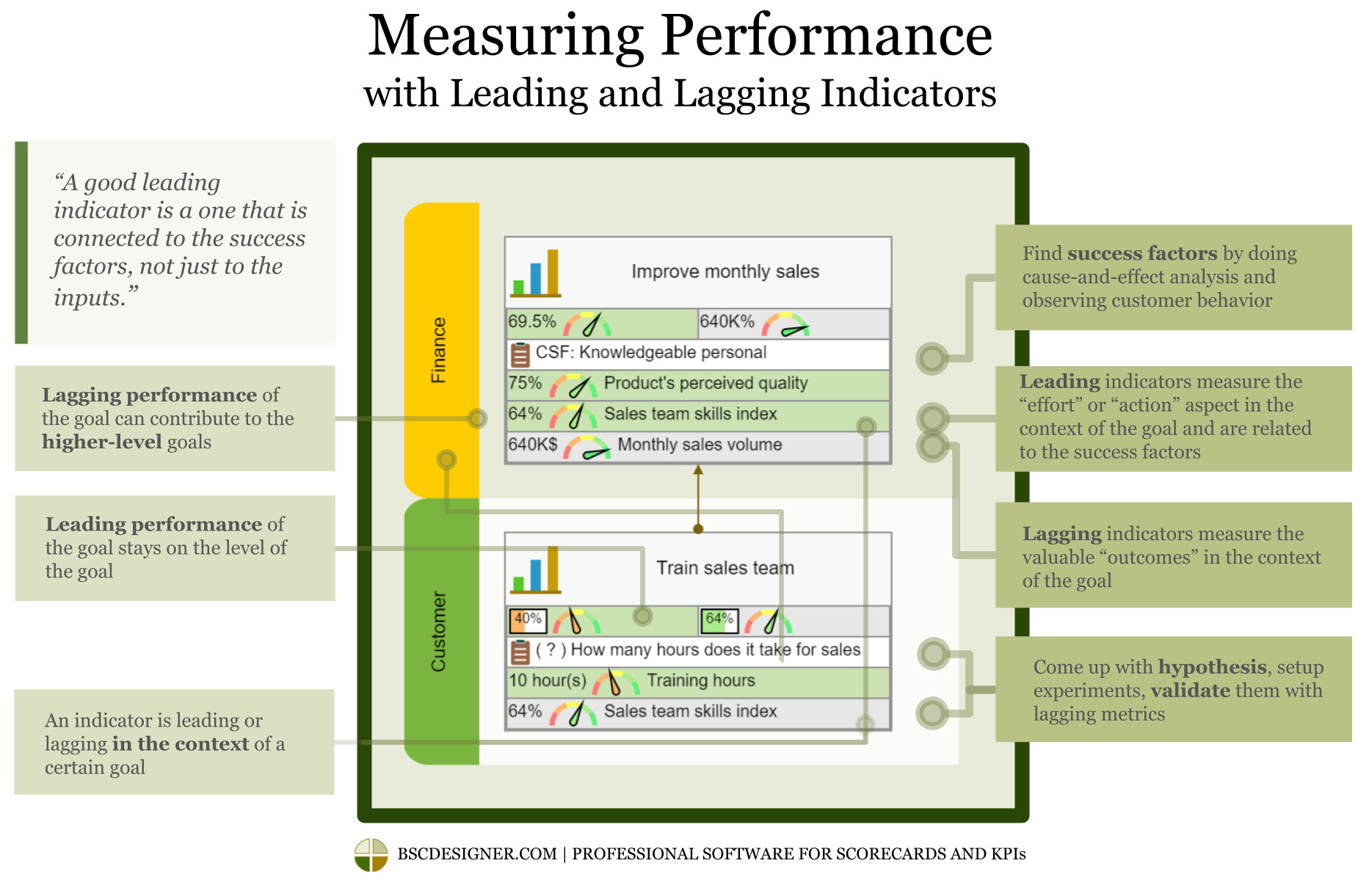

Measure the progress of OKRs using Leading and Lagging Indicators

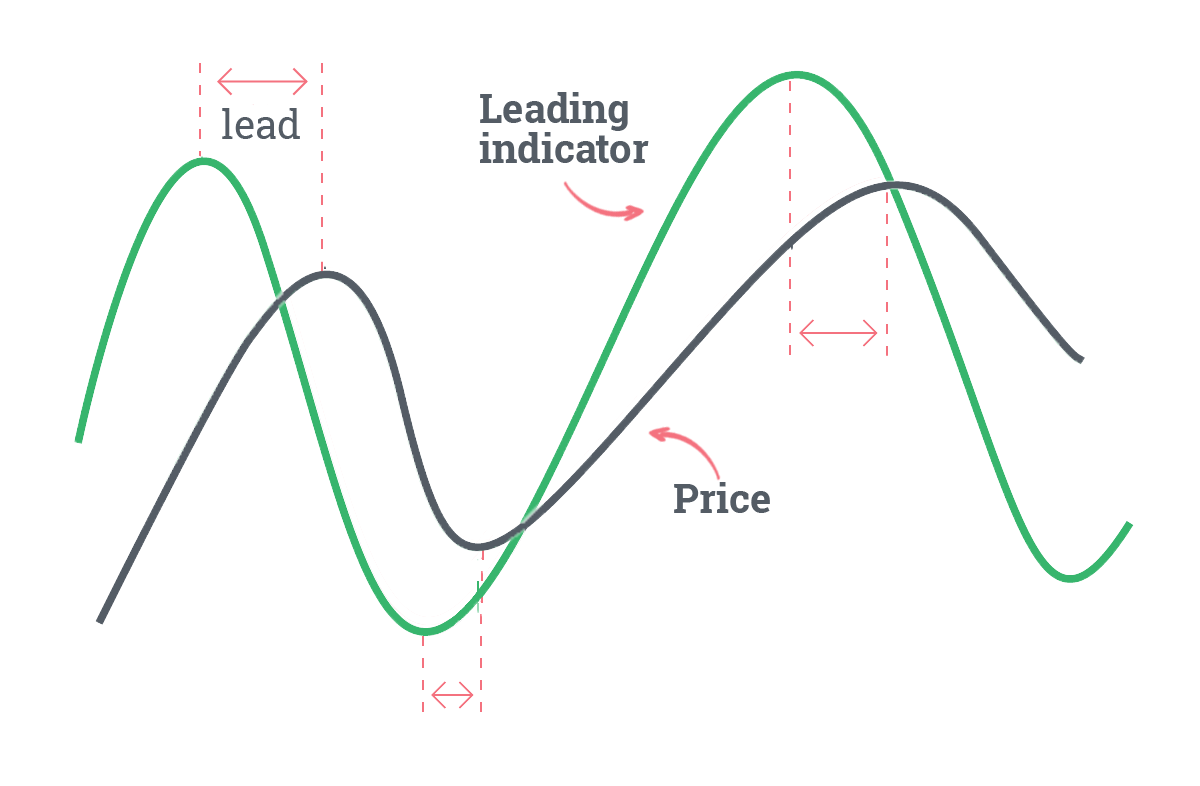

Leading vs. Lagging Indicators Which Should You Trade With?

10 key economic indicators for investors What are the macroeconomic

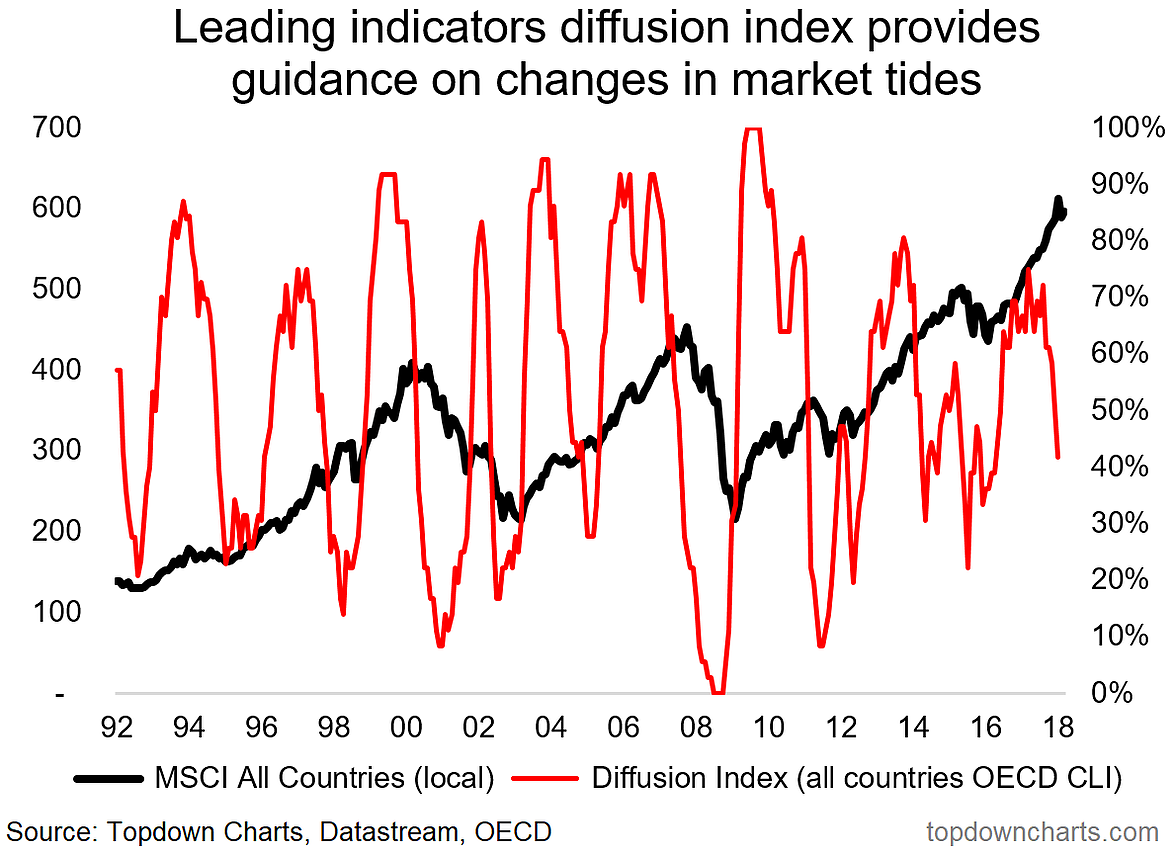

OECD Leading Indicators Show Global Economy At A Turning Point

What Are Leading Indicators Definition And Meaning

Success Factors and Leading Metrics vs. Lagging Indicators (2022)

Leading and Lagging Indicators in Forex FXSSI Forex Sentiment Board

What are Leading Indicators? Definition and meaning Market Business News

Leading vs lagging indicators Metrics and KPIs Geckoboard blog

CONVEY '20 How Using Leading Indicators Improves Workplace Safety

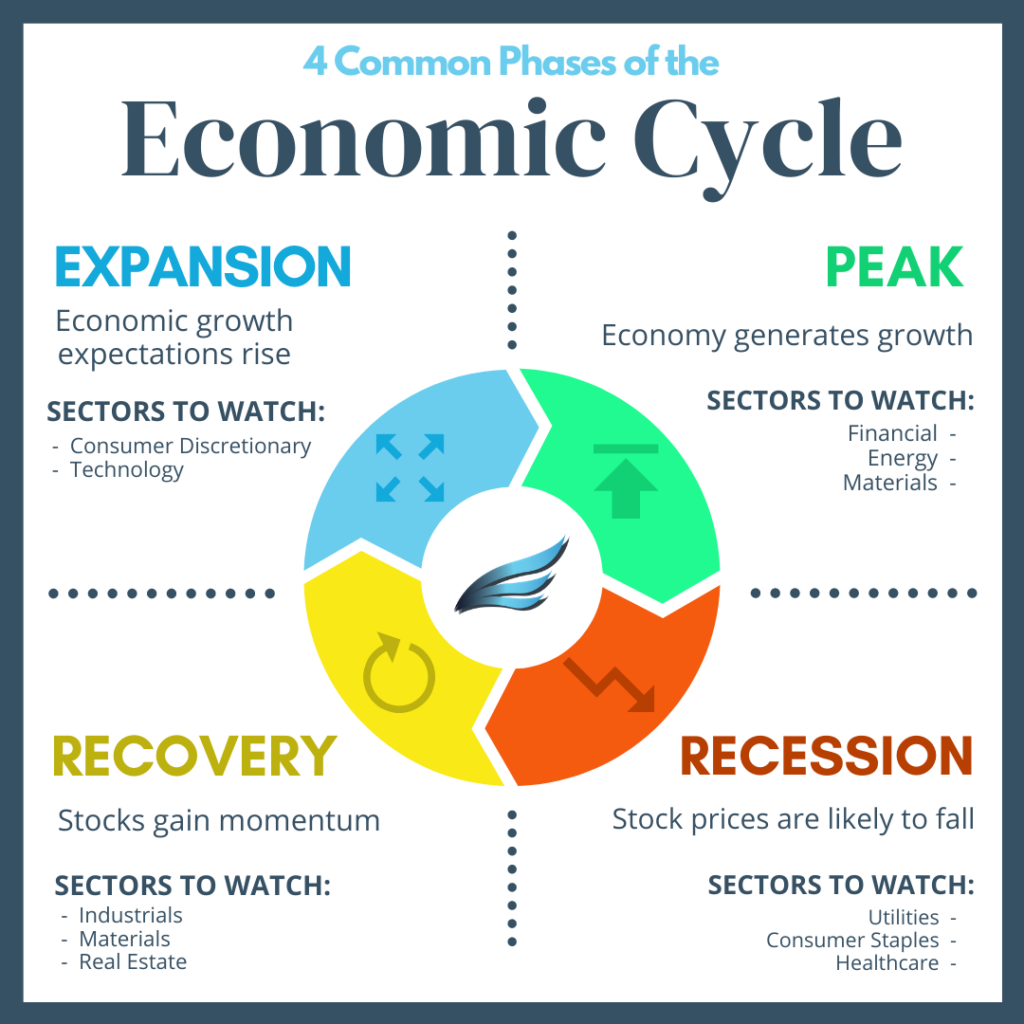

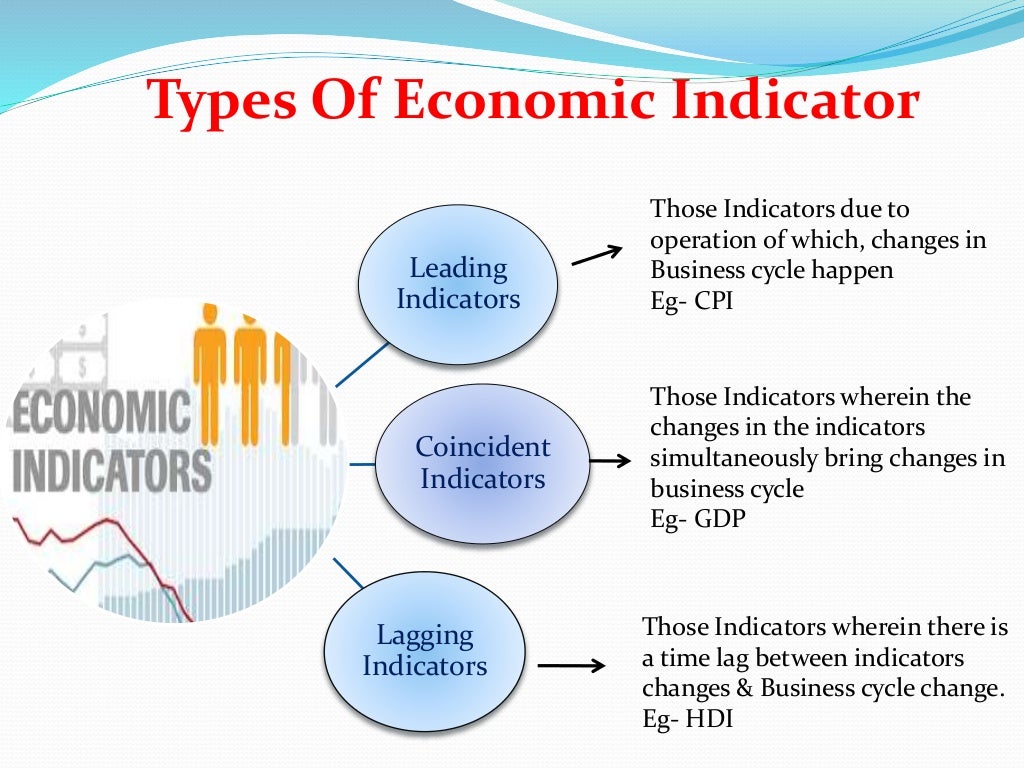

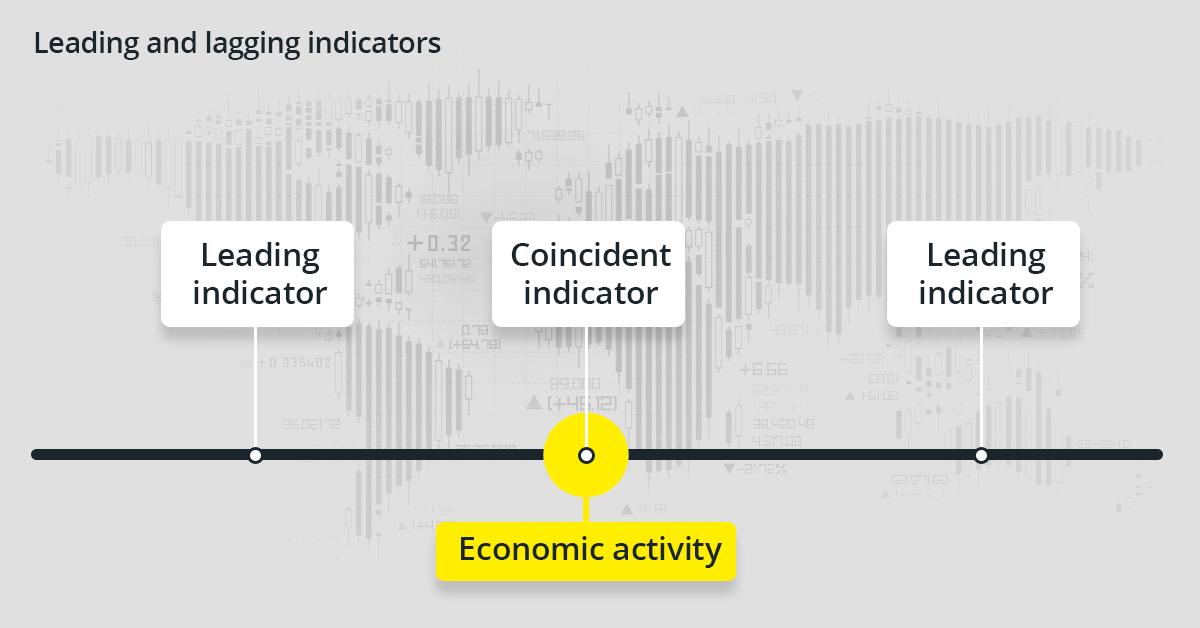

To assess this, economists rely on three sets of business cycle indicators: leading, lagging, and coincident indicators. Leading indicators are used to help predict the future course of an economy - generally short-term is 6-12 months ahead or up to 12-24 months longer term. The turning points of the business cycle are an indicator that tends.. Examples include stock market returns, the index of consumer expectations, and new orders for capital goods. 2. Lagging Indicators. Lagging indicators provide information about the economy's performance after an event or change has occurred. These indicators are useful for confirming the pattern suggested by leading indicators.