Abstract. A five-factor model directed at capturing the size, value, profitability, and investment patterns in average stock returns performs better than the three-factor model of Fama and French (FF 1993). The five-factor model's main problem is its failure to capture the low average returns on small stocks whose returns behave like those of.. Current Research Returns. In this paper Fama and French explain how they produce the U.S. factor returns in their Data Library and they estimate the effect of the two changes in their process and five major CRSP data-improvement projects on the average values of SMB and HML. March. 2024.

FamaFrench Factors and Parameter Optimization

(PDF) Using FamaFrench Fivefactors Model to Analyze the Impact of COVID19 on U.S. Medical and

(PDF) A New FamaFrench 5Factor Model Based on SSAEPD Error and GARCHType Volatility

(PDF) FamaFrench 5Factor Model and Its Applications

(PDF) Pricing Assets with Fama and French 5Factor Model a Brazilian market novelty

PPT CHAPTER 7 PowerPoint Presentation, free download ID1625991

(PDF) Do the FAMA and FRENCH FiveFactor model forecast well using ANN?

(PDF) Analysis of US Sector of Services with a New FamaFrench 5Factor Model

如何评价 Fama 和 French 最初于 2013 年提出的五因素定价模型 (Fivefactor Asset Pricing Model)? 知乎

:max_bytes(150000):strip_icc()/fama-4196653-b2f48bc85216461ab6f626e63818552c.jpg)

Fama and French Three Factor Model Definition Formula and Interpretation

FamaFrench Factors and Parameter Optimization

(PDF) FactorBased Investing in Market Cycles FamaFrench FiveFactor Model of Market Interest

Predictions of FamaFrench 5 factors Model during 2008 Crisis This... Download Scientific Diagram

Summary statistics of FamaFrench five factors (period July 2010May 2015) Download Table

Wat is smart beta of factor investing?

Factor Investing Insights You Won't Hear from Fama and French

FiveFactor Personality Model Archives Farther to Go!

What are the FamaFrench Five Factors? YouTube

An Empirical Test of the FamaFrench FiveFactor Model Applicability to Equitized StateOwned

(PDF) Portfolio Construction in Terms of APPL Based on Fama and French Fivefactor Model

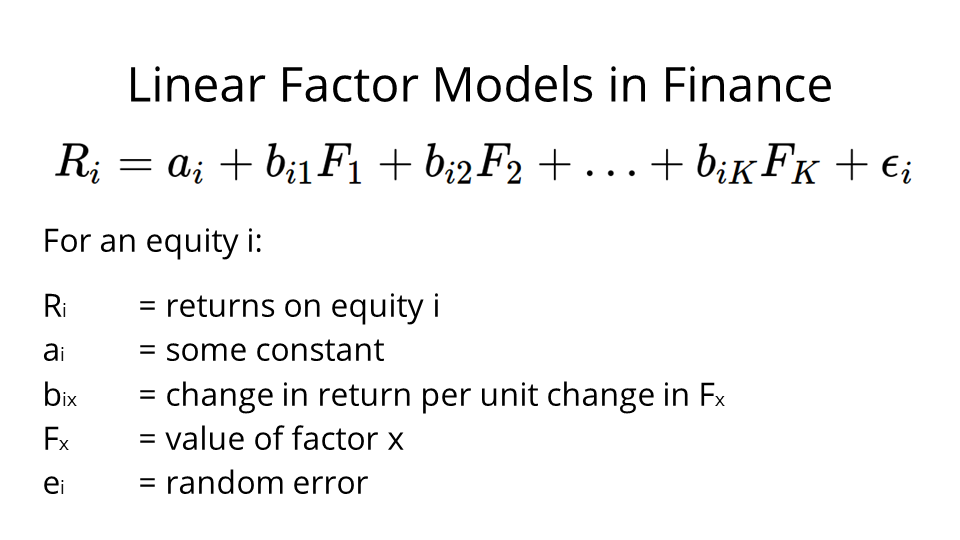

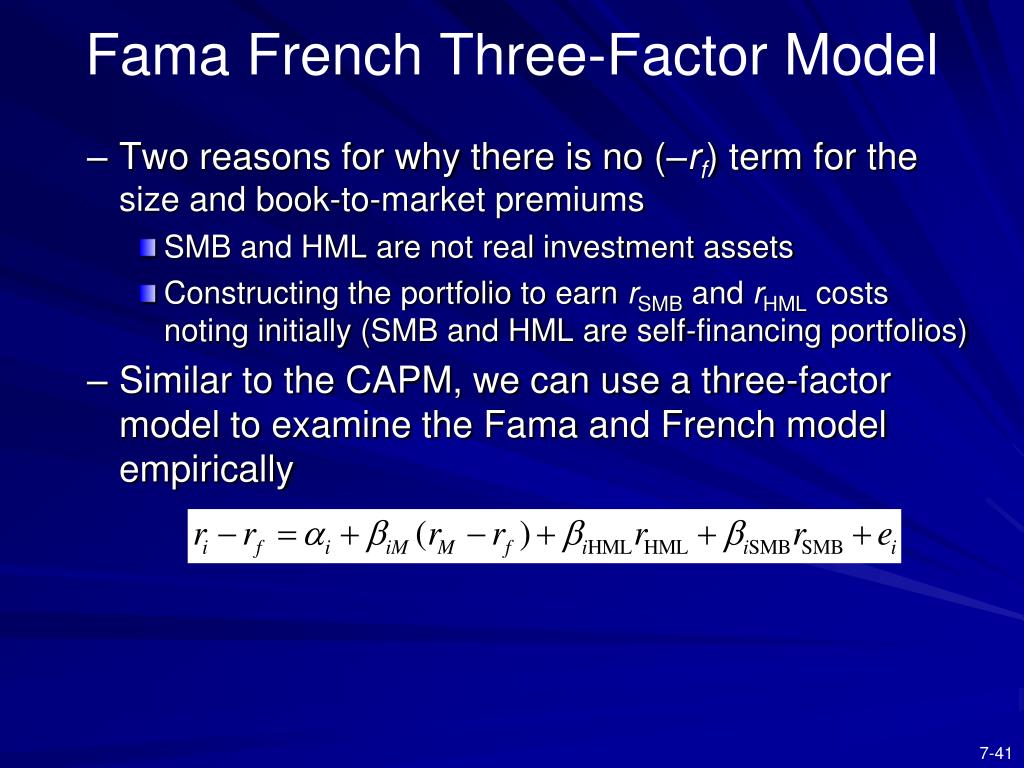

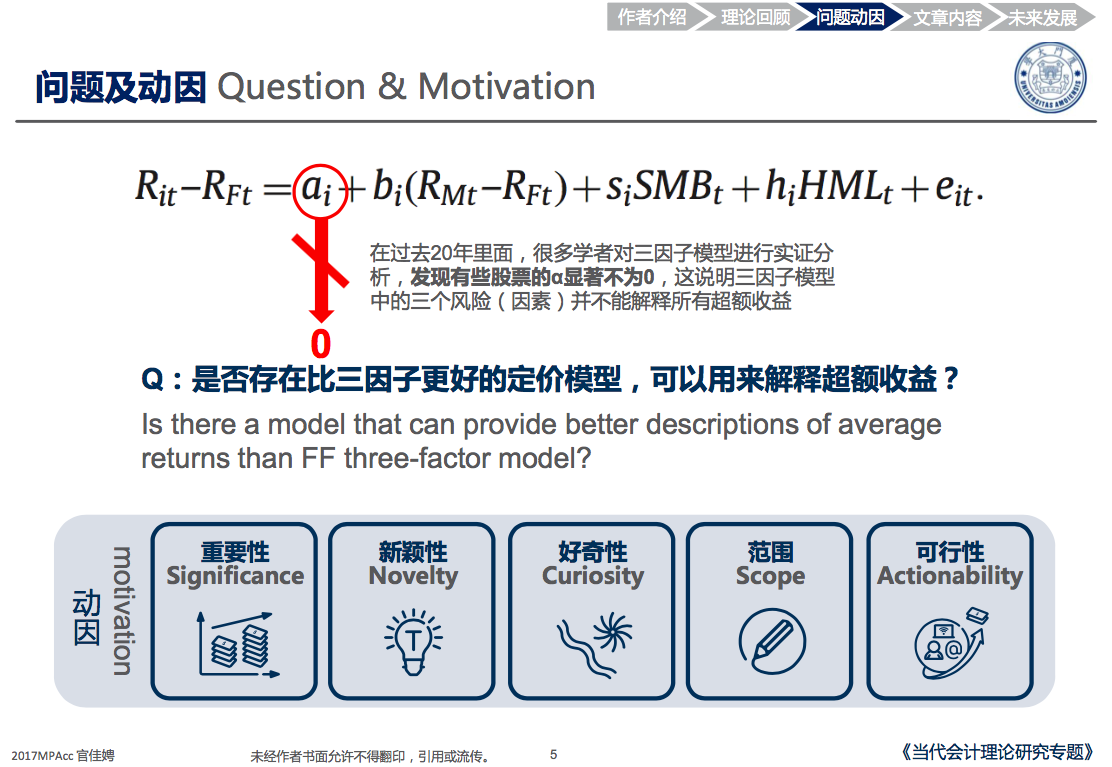

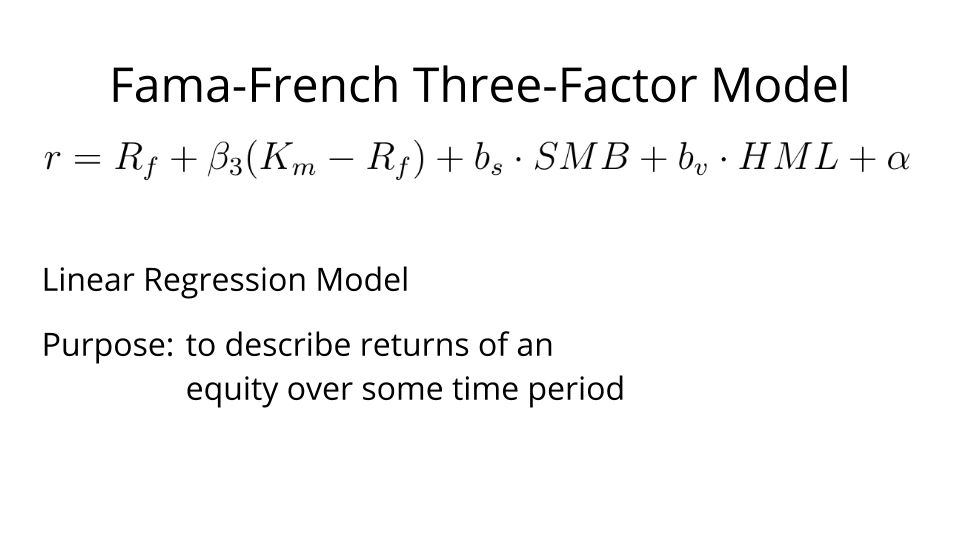

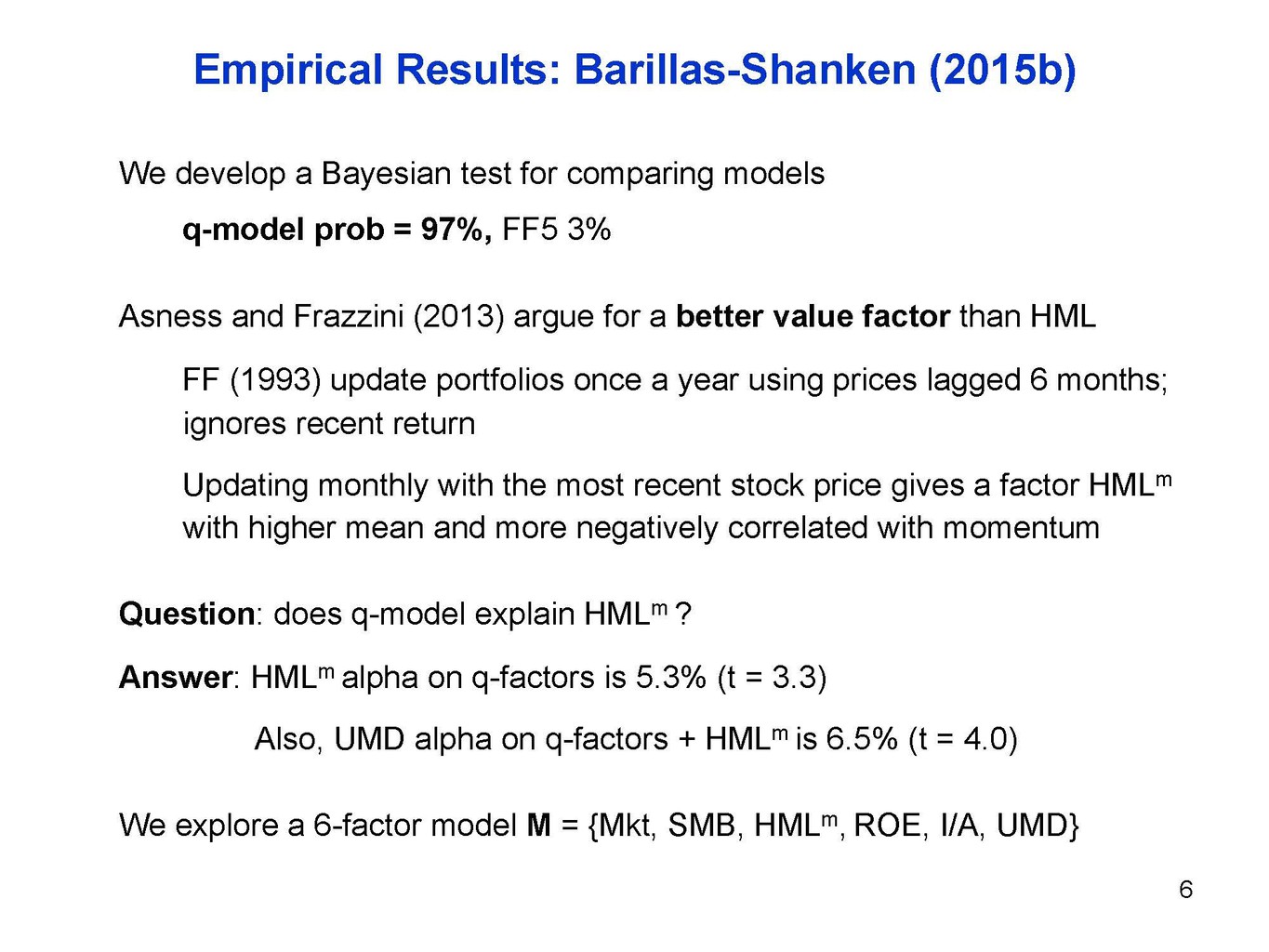

The Fama French five-factor model was proposed in 2014 and is adapted from the Fama French three-factor model (Fama and French, 2015). It builds upon the dividend discount model which states that the value of stocks today is dependent upon future dividends. Fama and French add two factors, investment and profitability, to the dividend discount.. The Fama-French factor models are a cornerstone of empirical asset pricing Fama and French . On top of the market factor represented by the traditional CAPM beta, the three-factor model includes the size and value factors to explain the cross section of returns. Its successor, the five-factor model, additionally includes profitability and.