This means that employers must pay 11% of an eligible employee's ordinary time earnings into their superannuation fund. Ordinary time earnings include salary, wages, bonuses, and commissions. The superannuation guarantee rate is scheduled to increase to 12% on 1 July 2025. Your obligations may be higher under an agreement, award or common law.. In other words, employers must pay super on what an employee earns for their ordinary hours of work, which depending on the employee may include certain allowances, annual leave, sick leave and certain types of bonuses. So, whether an employer must pay super on bonus payments will depend on whether the bonus is within the employee's OTE.

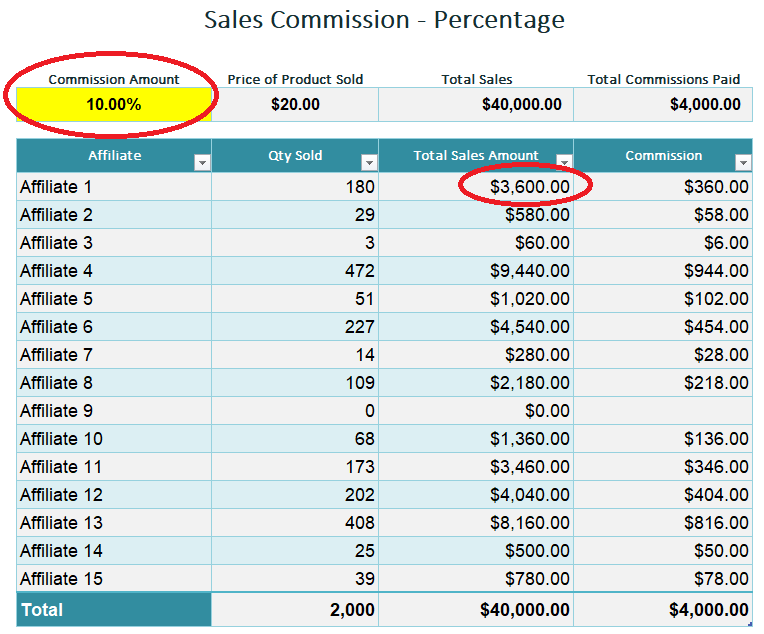

How Do Affiliate Marketers Get Paid? Here's Everything You Need To Know Commission Academy

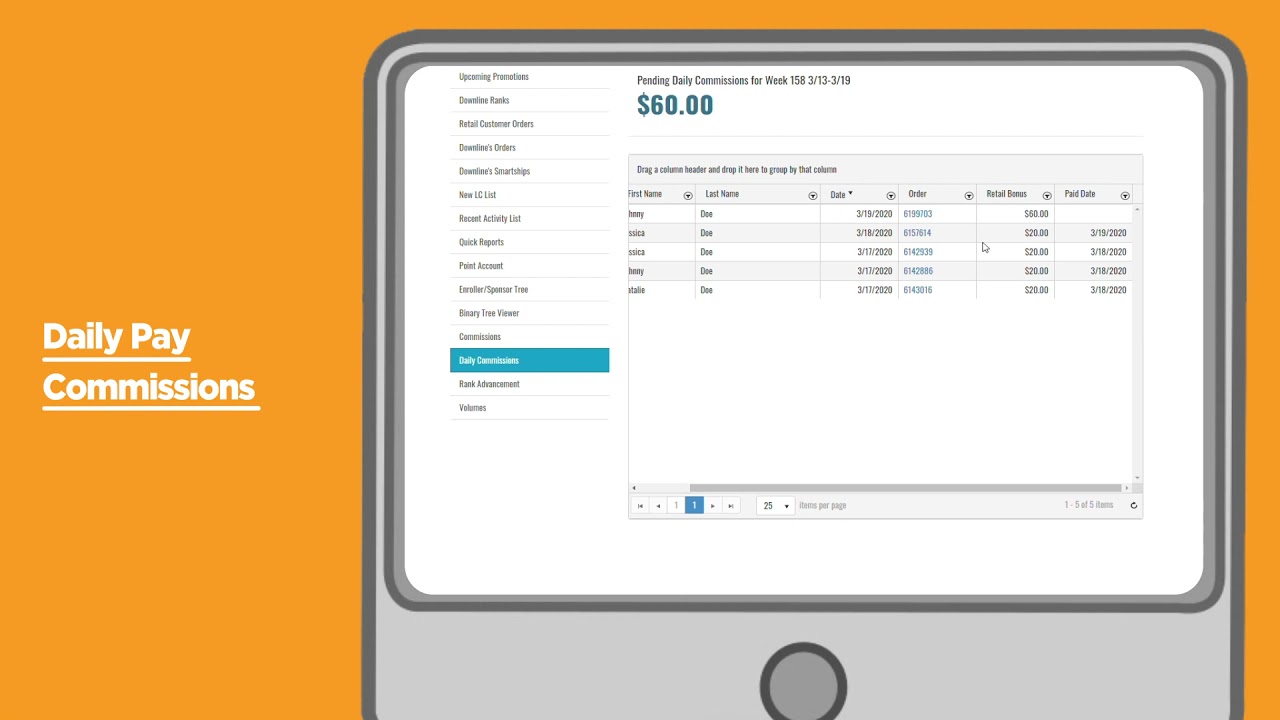

Understanding Your Daily Pay Commissions YouTube

SUPER pay

7TH CENTRAL PAY COMMISSION NEW PAY MATRIX WITH DISTINCT PAY LEVELS FOR CIVILIAN EMPLOYEES The

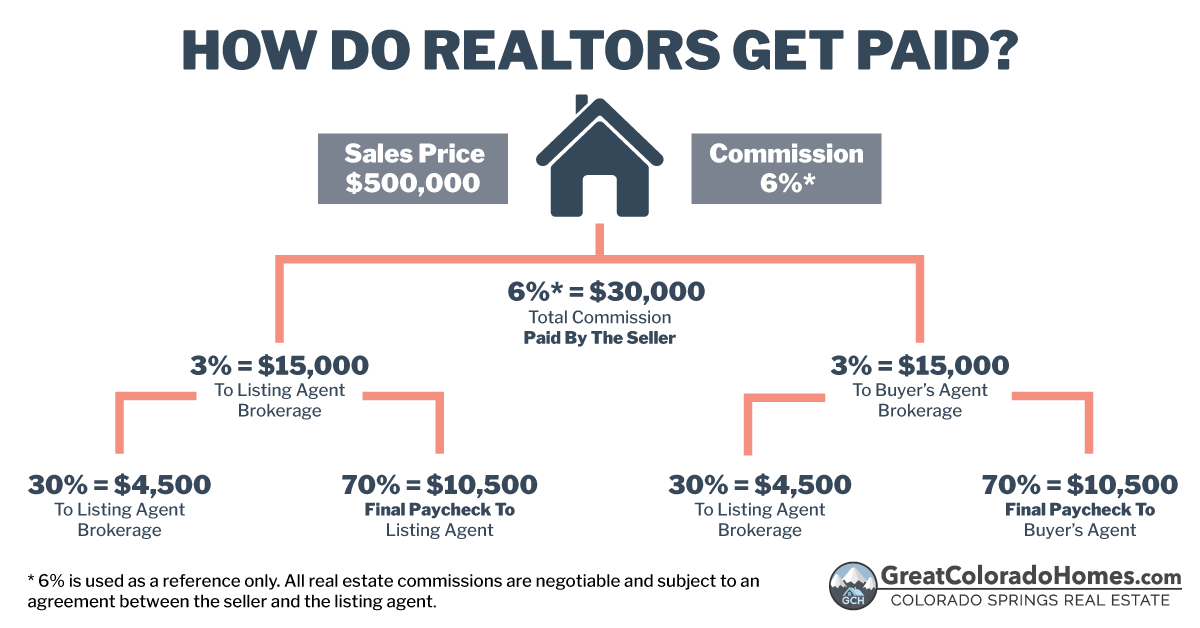

How Do Realtors Get Paid? Who Pays Agent Commissions?

Sales Commission Invoice Template Invoice Maker

How to Turn a Commission Campaign into a Paid Campaign

How To Pay Commissions Only When You Get Paid Sales Commissions Explained

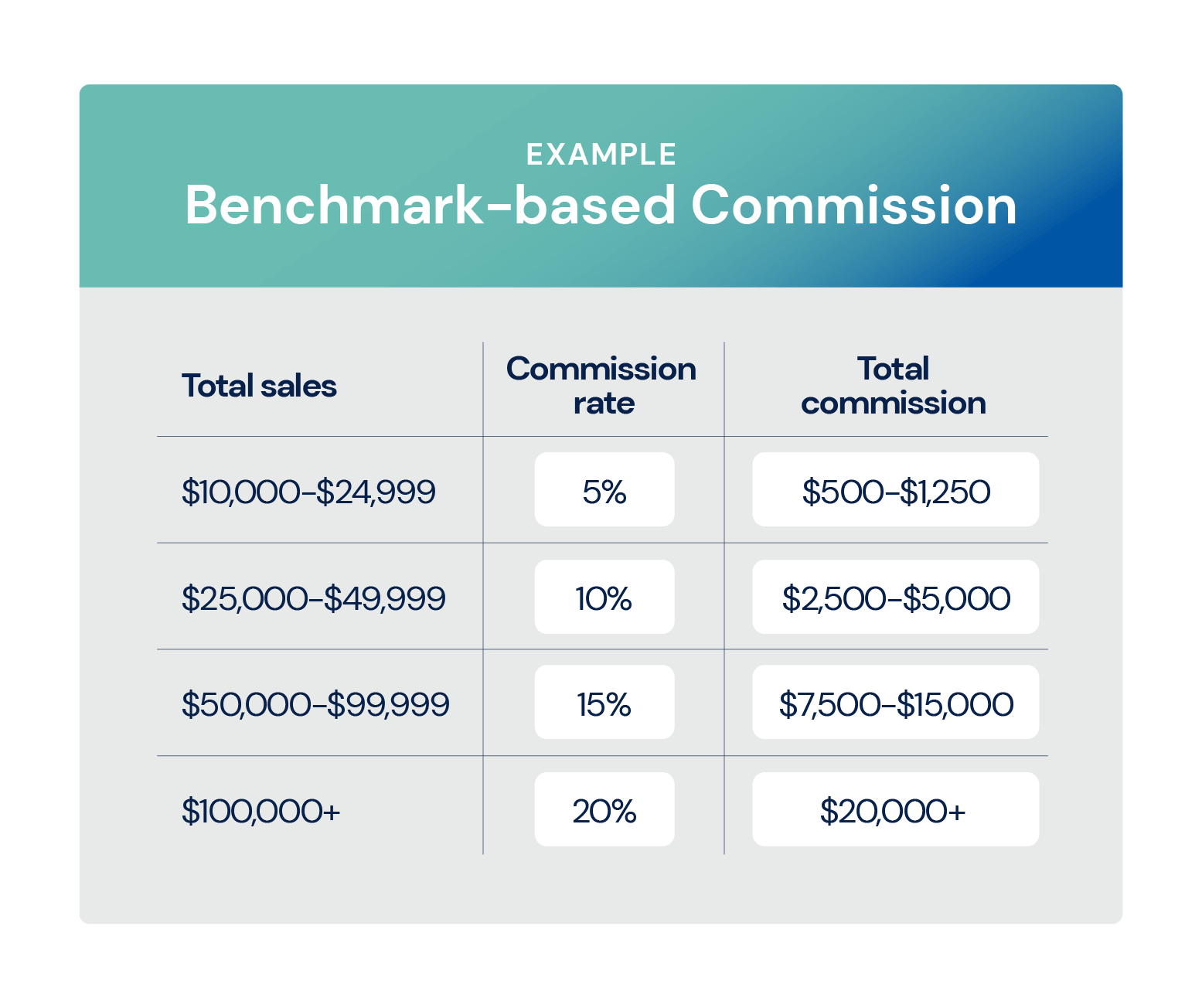

11 Sales Compensation Plan Examples To Inspire Reps Mailshake

Commission Defined and How to Account for Commissions Earned

Paid on Commission? The Workers’ Comp Benefits You Can Expect Best Law Firm For Workers

Self Managed Super Funds (SMSFs) EXPLAINED YouTube

5 important facts you should know about signon bonuses before you accept your next job offer

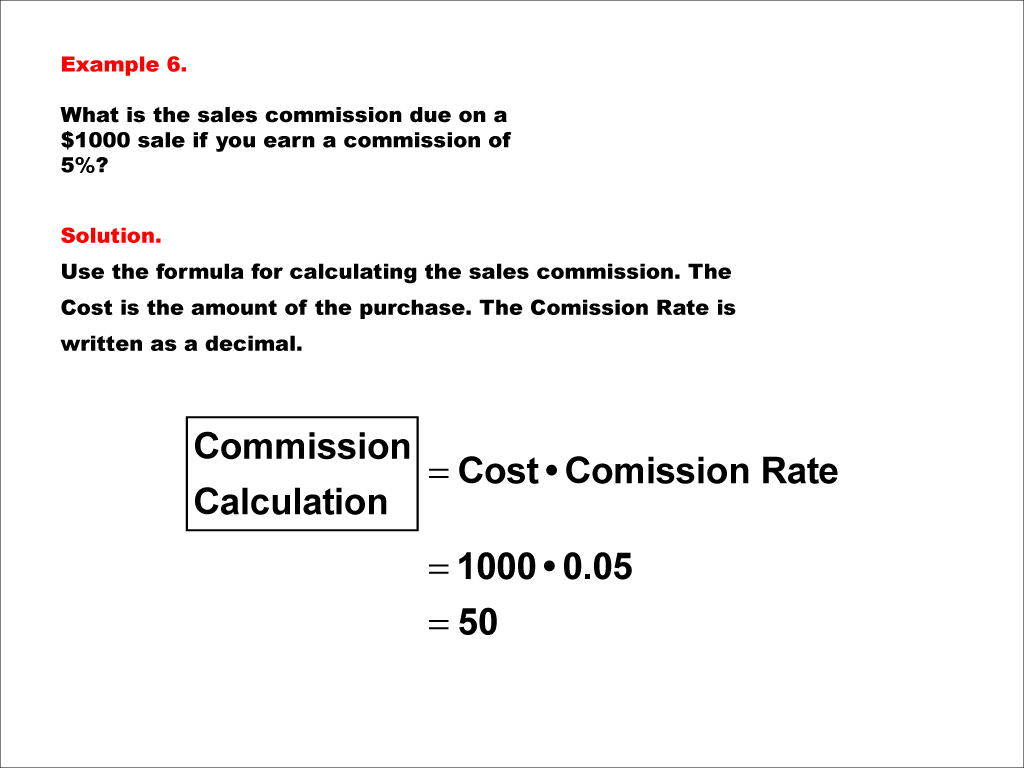

Student Tutorial Calculating Commissions and Tips Media4Math

![How Insurance Agent Commissions & Pay Works [No BS] YouTube How Insurance Agent Commissions & Pay Works [No BS] YouTube](https://i.ytimg.com/vi/_O-S1sAOvYo/maxresdefault.jpg)

How Insurance Agent Commissions & Pay Works [No BS] YouTube

A Breakdown of Average Sales Rep Commission Rates by Industry Map My Customers

How Are Affiliate Commissions Paid EmoneyPeeps

Introducing Super Dispatch’s Payment Feature, SuperPay

Superpay.me Help Guide YouTube

The 1 Guide on How to Pay Super as an Employer BOX Advisory Services

Commissions must be paid on a monthly basis, and the court concluded that they must be earned in the month that the employee performed the work to make the relevant sale. Bonuses, on the other hand, are much more open-ended and give employers more discretion to impose conditions and delay payment.. When is the super contribution calculated, on Gross Commission or after the split.. These earnings are what the employer is required to pay super on once the earnings are paid to you. Generally speaking, eligible employees will be paid the 9.5% Super Guarantee Contribution rate on gross salary and wages, however there may be further.