Why a low income businesses should become a limited company. A sole trader with a profit below the personal allowance and the Class 4 National Insurance lower limit will not be liable to pay any tax, but if they earn above the small earnings exception (£6,025 for 2017/18 and £5,065 for 2016-17), then they will be liable to pay Class 2 NI.. Minimum tax on turnover. Where the tax payable by a company is less than 1.25% of the turnover, the company is required to pay a minimum tax equivalent to 1.25% of the turnover, except where the company is exempt from levy of minimum tax. In certain cases/sectors, such turnover tax is payable at rates less than 1.25% (ranging from 0.25% to 0.75.

What is the minimum turnover for GST? Indiafilings

8 Tips to Give your Managers to Decrease Employee Turnover

SME Definitions in Terms of Annual Sales Turnover Download Table

:max_bytes(150000):strip_icc()/Turnover-Final-d59a18de4afb4752b9cb2d8c8ef105c9.jpg)

What Is Turnover in Business, and Why Is It Important?

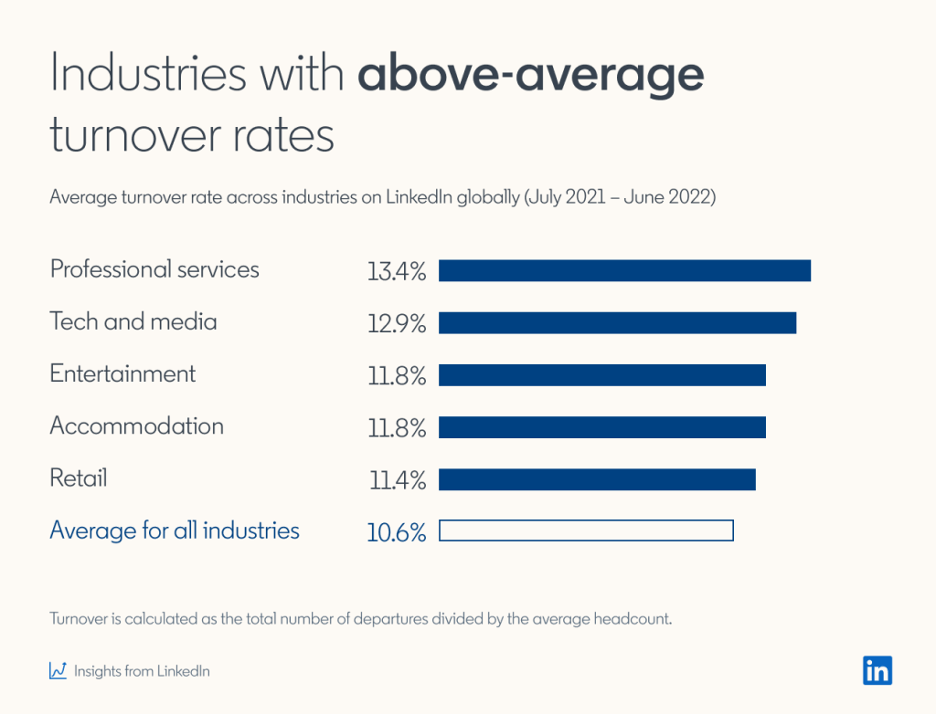

![How To Calculate Turnover [Free Calculator] Built In How To Calculate Turnover [Free Calculator] Built In](https://cdn.builtin.com/sites/www.builtin.com/files/styles/ckeditor_optimize/public/inline-images/national/turnover-rate-by-industry_0.png)

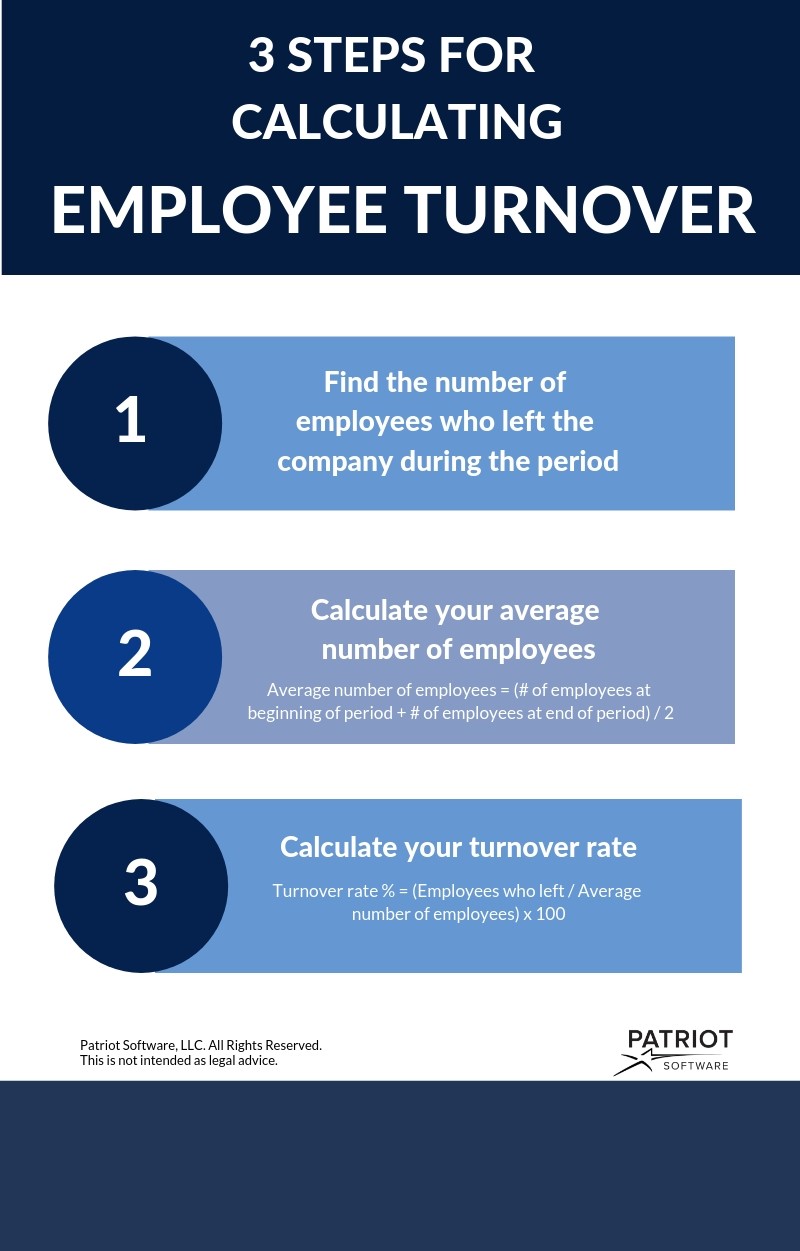

How To Calculate Turnover [Free Calculator] Built In

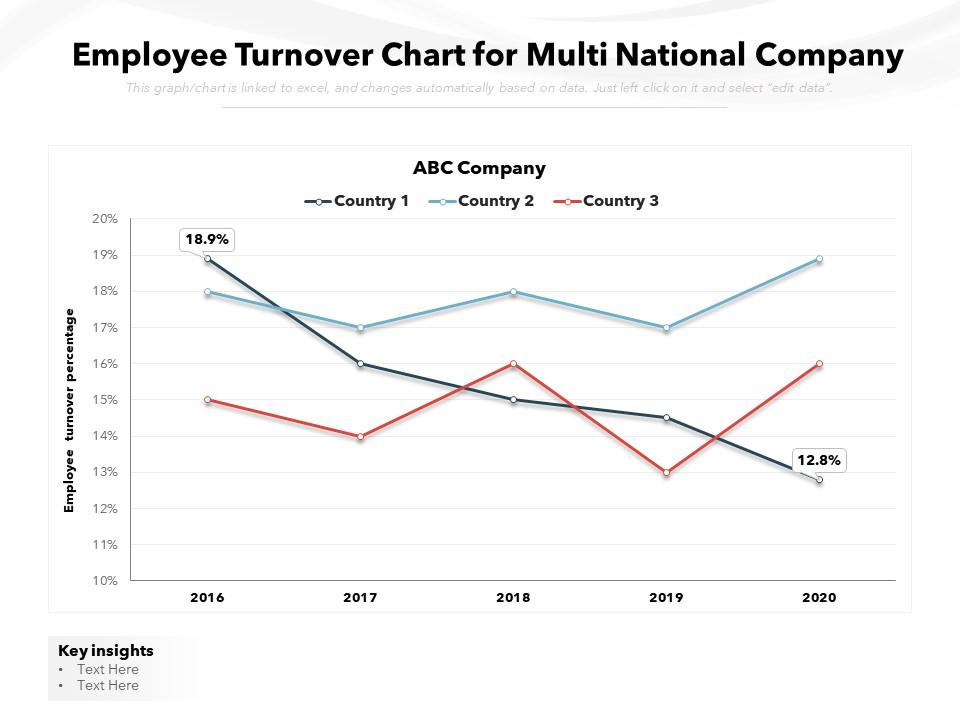

Employee Turnover Chart For Multi National Company Presentation Graphics Presentation

Employee turnover Bestpractices to understand & Eliminate it

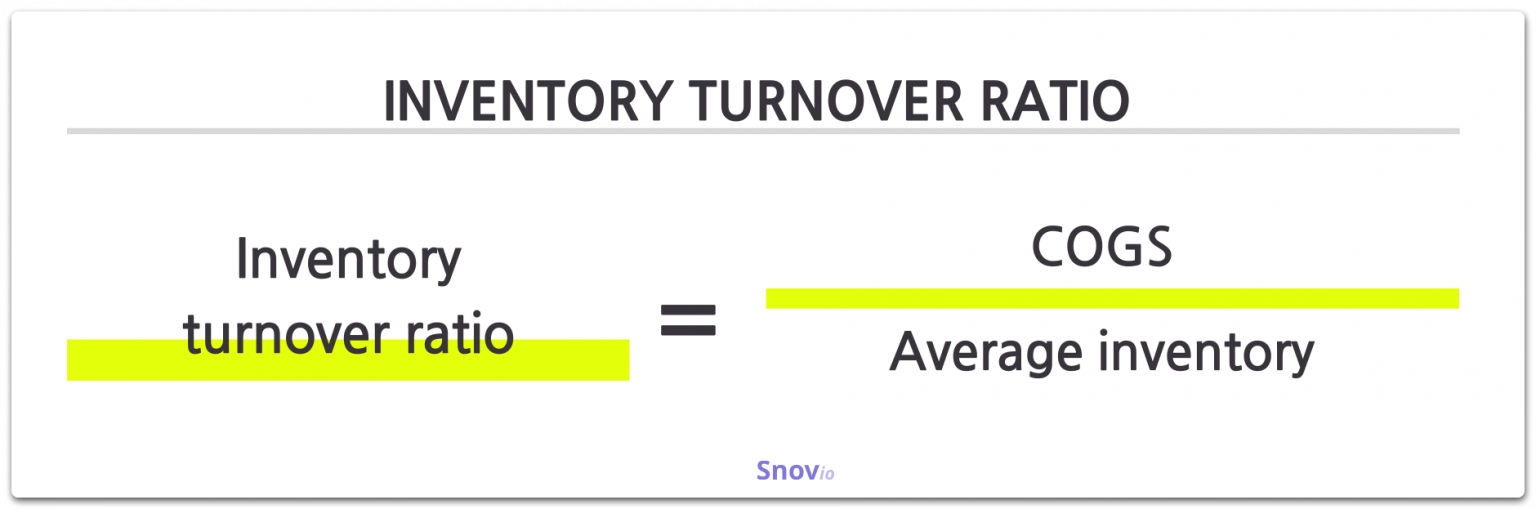

What is Sales Turnover Definition and ratio formulas Snov.io

Infographics Basic Comparison between Private Limited Company / LLP / OPC

![How to calculate staff turnover [+ free online calculator] How to calculate staff turnover [+ free online calculator]](https://blog.rotacloud.com/content/images/2021/07/employee-turnover-rate-calculation-image.png)

How to calculate staff turnover [+ free online calculator]

Minimum turnover for a business loan

Employee Turnover Costs, Causes & Reduction Qualtrics

8 Employee Retention Metrics You Need to Measure

How Do I Calculate Turnover Of A Business Business Walls

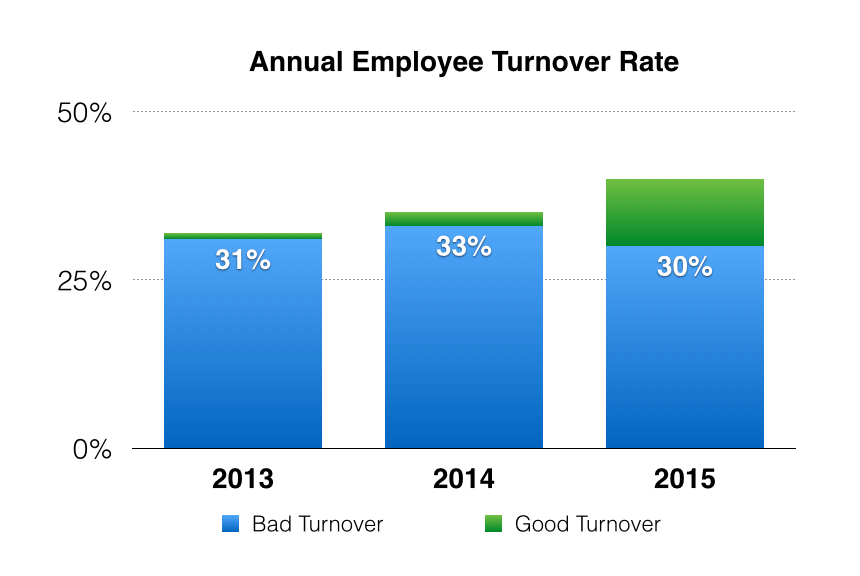

15 Employee Turnover Statistics To Shape Your Retention Strategy

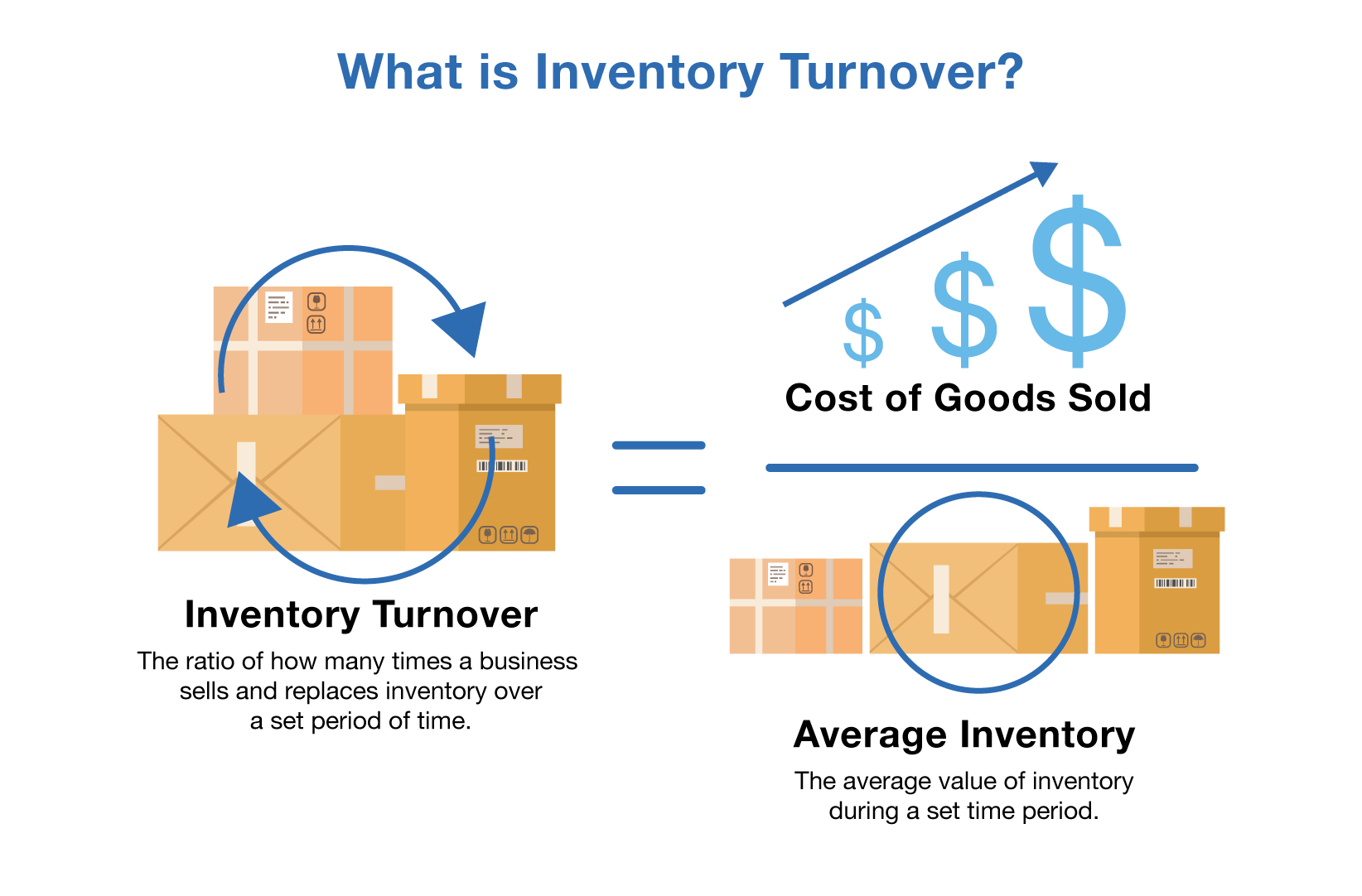

Inventory Turnover Ratio, Definition & Formula

How Understanding Accounts Payable Turnover Helps Your Business

Infographic 7 Key Employee Turnover Statistics HR Blog & Resources Medium

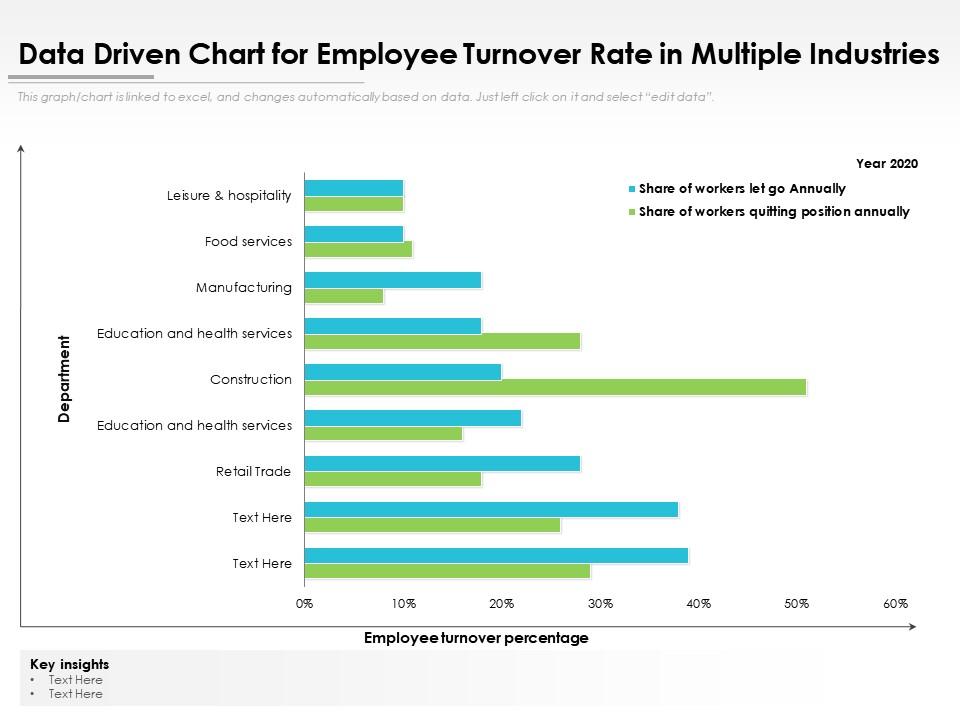

Data Driven Chart For Employee Turnover Rate In Multiple Industries Presentation Graphics

Does Your Customer Service Team Have a Turnover Problem? — Jeff Toister

For example, a public limited company must have a minimum amount of £50,000 of share capital, while there is no minimum for a private limited company.. If your business turnover exceeds the VAT threshold, currently £90,000, then your company must be registered for VAT opens in new window and quarterly VAT returns completed online. If.. Putting it all together - the best way to pay yourself as a director. Taking all the above taxes together, in the 2023/24 and 2024/25 tax year, it's usually tax-efficient for most limited company directors to take a monthly salary up to the NI Secondary threshold of £758.33 per month, or £9,100 per year. As we mentioned at the start of this.