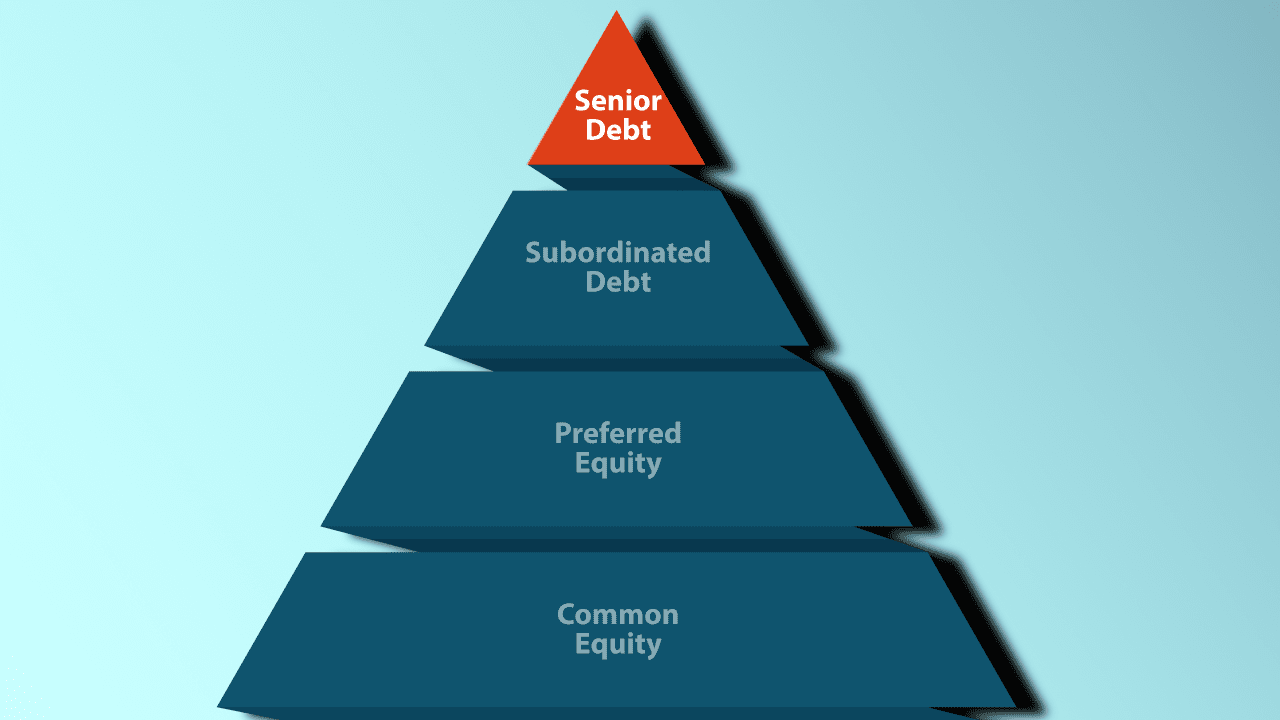

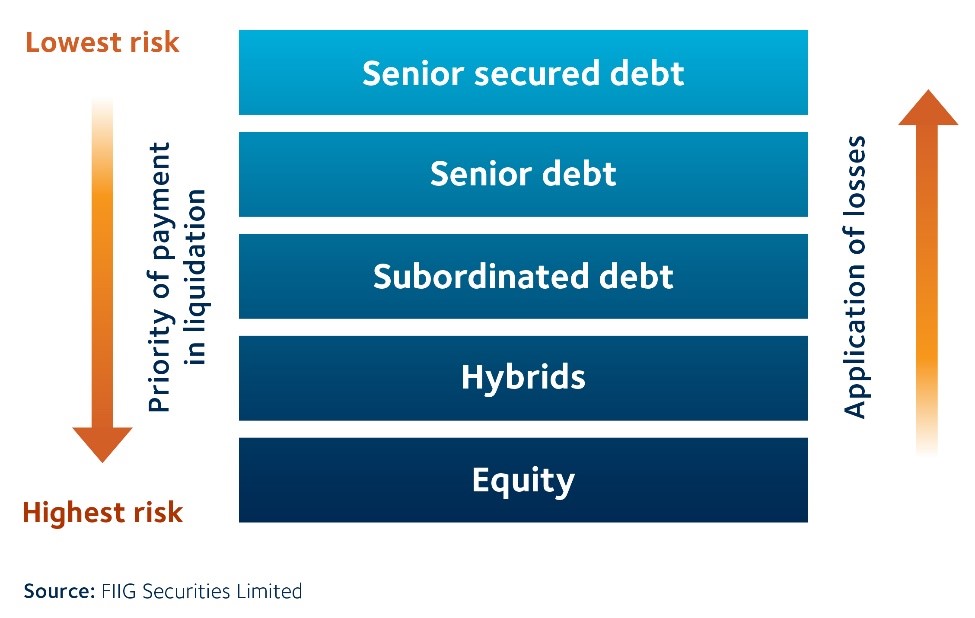

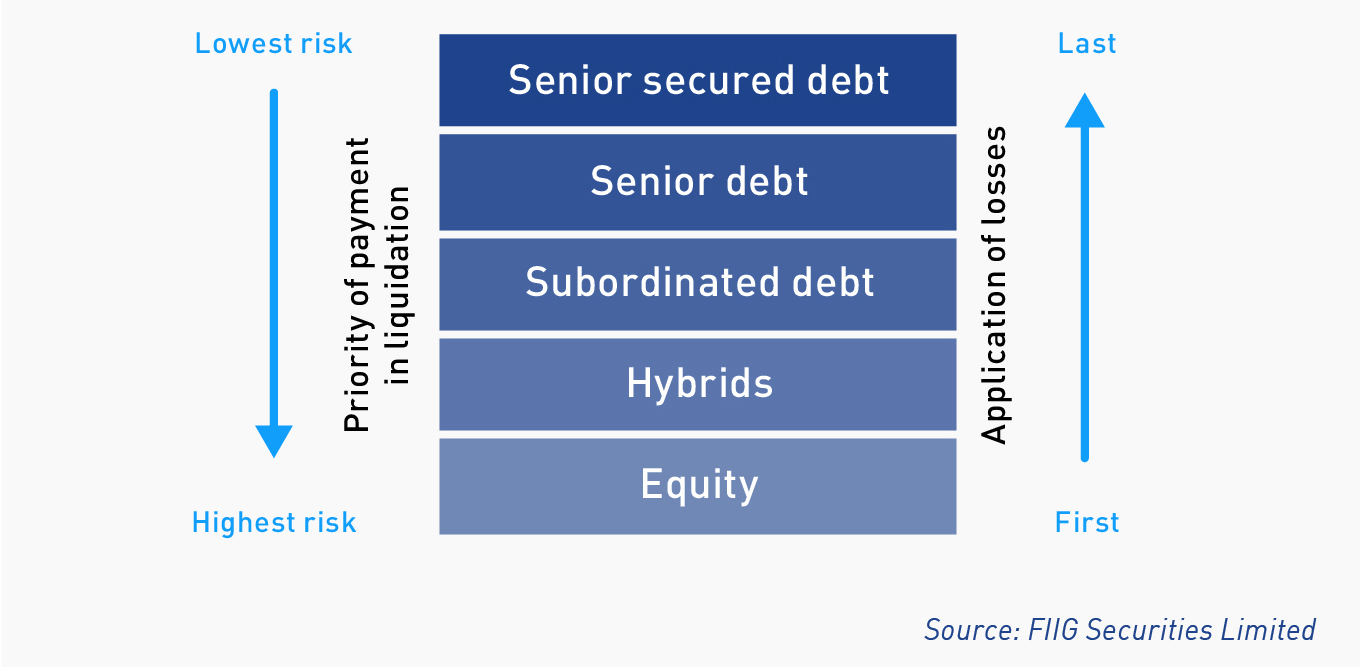

In uncertain economic environments, investing in senior secured debt can be defensive in nature. It is the most senior part of a company's capital structure, and therefore typically has the first claim on the assets and cash flows of a company. This means senior secured loans receive payment in full before other security-holders in a firm.. Subordinated debt, or junior debt, is less of a priority than senior debt in terms of repayments. Senior debt is often secured and is more likely to be paid back while subordinated debt is not.

Mezzanine Finance vs Senior Debt Octagon Capital

What is Senior Debt? Financing Characteristics + Examples

Secured debt Free Creative Commons Images from Picserver

Senior Debt What is Senior Term Debt? YouTube

Seniority Ranking What It Is How It Works Definition Examples Senior vs Junior Debt

Page 6

Senior Secured Debt Can Be Lucrative for Investors Investing US News

Out Of This World \what Do Figures In Brackets Mean On A Balance Sheet? Partnership Sheet Format

What is Fulcrum Security? ValueBreak Analysis

Seniority ranking PrepNuggets

Perpetual knowledge bank series seniority of assets

Senior Debt Capital Sources

:max_bytes(150000):strip_icc()/what-difference-between-secured-and-unsecured-debts.asp-final-c2040f78625b44d98372ea024fa51697.png)

What are the cons of a secured loan? Leia aqui What are the advantages and disadvantages of a

Senior Debt Vs Junior Debt Introduction, Differences and More eFM

Secured Debts vs Unsecured Debts Understand The Differences

Senior Debt in a Company’s Capital Structure Crystal Capital Partners

Subordinated debt and hybrids square off

AE Biofuels Senior Secured Debt Facility Bryant Park Capital

A simple guide to bond terms and returns

Backcast Partners provides senior secured debt and preferred equity to finance an acquisition

Senior secured debt stands as a cornerstone of financial strategy, delivering a unique blend of security, risk reduction, and possible profits. It is the safest kind of loan for both borrowers and investors because of its high ranking and collateral backing, which reduces risk in an otherwise volatile market... Senior secured debts are generally used by companies to finance expansions or acquisitions, so investors need to make sure the bundled deal is favorable - for example, that it's a debt of $20.